Medicare Supplement

What are Medicare Supplements

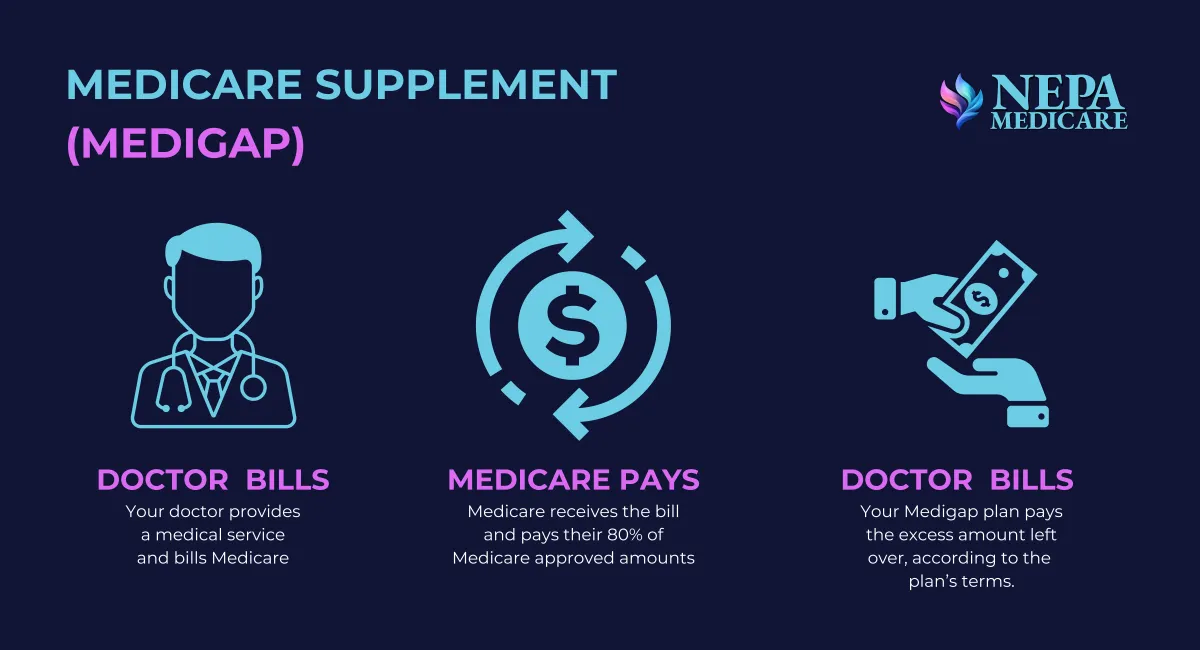

Medicare Supplements are sold by private insurance companies and also known by Medigap policies. These policies help cover the out-of-pocket expenses that Medicare does not cover. With a Medigap policy, your medical expenses will be covered by Medicare up to its limit. Once your Medicare limit is hit, then your Medicare supplement will cover the amount up to its limit. Medicare Supplement limits will usually pay of the remainder of your expenses. As always though, that will depend on which policy you choose.

10 Medigap plans

Each private insurance companies have standardized guidelines which are set by Medicare.

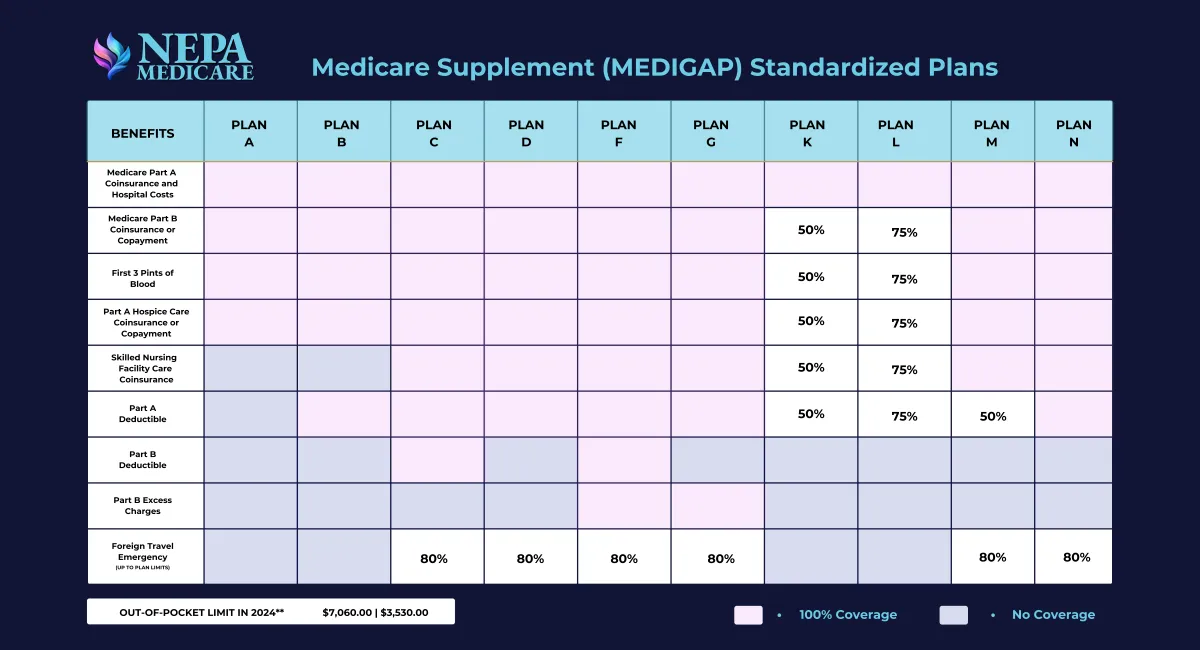

There are 10 Medigap plans:Every company has to follow the standardized guidelines set by Medicare.

The Medigap plans are Plan A, B, C, D, F, G, K, L, M, and N. No matter which company you purchase your Medigap plan from, their plans feature the same set of benefits. The doctor's networks are all the same (the Medicare network) and claims experience is the exact same since all claims are handled by Medicare. The only difference between a Plan G with Company A and Plan G with Company B in the same area is the cost of the coverage. Cost is a big deal with Medicare supplement. That's why we shop the market for our clients.

To make things easy there are only 3 Medicare Supplement Plans that most people buy. Let's take a look at those.

Plan F

Medicare Part A will cover stays within a facility such as inpatient hospitals, skilled nursing and portions of home health care. Part A is typically free of charge.

Plan G

Medicare Part B covers all of your outpatient medical. This can include preventative care, surgeries and lab work. Part B will help pay for services that are medically necessary to diagnose or treat a medical condition and performed on an outpatient basis.

Plan N

Medicare Part D is also commonly known as prescription drug coverage. Part D is available as a Part C or as a Stand-Alone Option (PDP). Like Part C, these Part D plans are offered by private insurance companies.

Since the only thing that varies from company to company is price it makes sense to pick the cheapest of the plan type you wish to have when you first go on to Medicare because you get to select a plan without any medical underwriting. If you wish to change plans after that, you will have to health qualify to make a change. Health qualifications vary from carrier to carrier.